A mental model for aging drugs market readiness

Looking with a product mindset at the likelihood of aging interventions making their way from lab to real-world impact

Biotech operates mostly under the mantra of build it and they will come: assume that as long as the science works, the market will be there. But that may not be the case for longevity biotech focused on aging therapeutics. Indulge me an example.

It could be argued that interventions like replacement would be a much faster strategy than others since most of the science is already figured out; it's now mostly an engineering project. So from a science perspective, replacement is the obvious path forward. But from a product perspective, that's not the case. Let me explain ☝. Replacement has a big supply and demand problem. There are still too many people in need of a transplant. And it's hard to see how we could mass produce tissues and organs to have enough supply for both transplants and rejuvenation in the short term. Logistics are very complex for replacement. And don't even get me started on the affordability, public opinion and the regulatory framework we still need to deploy.

So over the past weeks I've been trying to understand which type of aging therapeutics are more likely to become a product in the short term and which will only reach the market after many iterations. Iterations on the science, technology, deployed capital, regulation, public opinion, distribution channels, marketing, talent pool and the market itself.

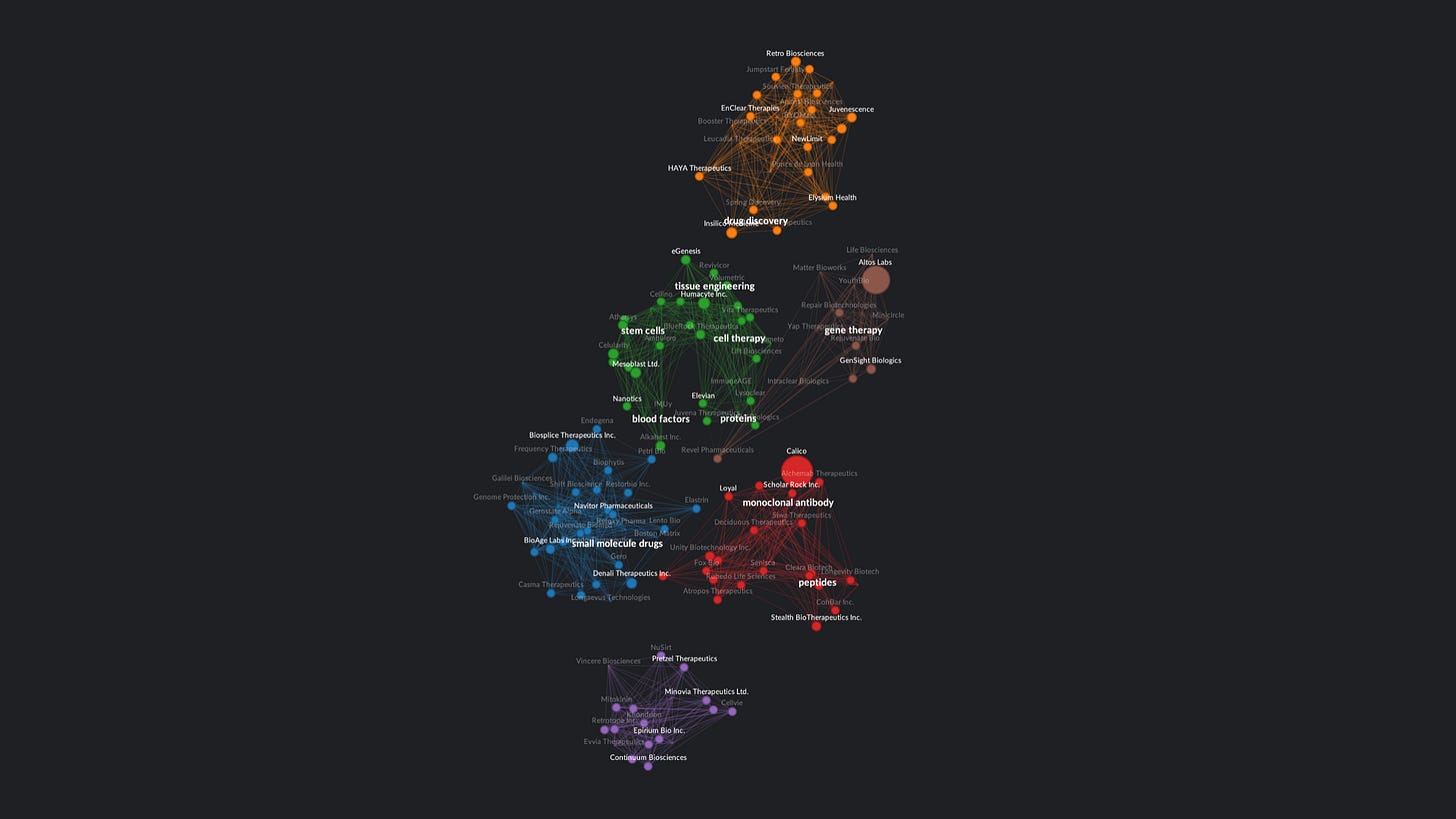

But I struggled to find a good mental model that could be useful for this product focused perspective. Initially, to visualize where the space is now, I grouped companies based on the hallmarks of aging they attempt to target: deregulated nutrient sensing, chronic inflammation, cellular senescence, etc. Then, I tried grouping them by the technologies they employ: small molecules, regenerative medicine, cellular reprogramming, etc. And finally I tried using several parameters (hallmark, technology, investment, size, etc.) to form clusters of similar companies:

And while this is a cool visualization and a good image for social media... it's not very useful. The reality is that the majority of these companies don't even focus directly on extending healthy lifespan. Instead, they aim to improve some indication (Alzheimer's, cancer, diabetes, etc.) by targeting some mechanism of aging.

Not all aging mechanisms share the same level of complexity. And some technologies and interventions are more promising than others. Promising from a product point of view. Building a permanent base on Mars is promising from a science perspective but I dare you to launch a Mars based product in the next 3 to 5 years. It's clear for me that some companies are more likely than others to bring a product to market in the short term. And it's likely that the capital allocated to each of them will be deployed at different points in time. Additionally, regulation for simpler interventions (although for sure less effective at slowing down or halting aging) will be easier to negotiate and create. Lastly, different interventions may have very disparate economical and social impacts.

So... different strategy. And a good strategy is mostly about understanding how we might get to where we want to be. But I still needed a way to understand where we are.

Inspiration

When I join a team, I spend a couple of weeks evaluating their level of maturity. I assess whether the team is customer-centric or focused on themselves, aligned with a purpose or struggling to collaborate, and whether resources are allocated effectively or stuck in silos. This enables me to create a mental model for how we could evolve as a team. Since static models don't work in a changing world, I modify this mental model as the level of maturity evolves. A good strategy evolves over time.

A similar approach can also be used to evaluate and coordinate technological advancements. For example, while developing ADAS for electric motorbikes, we used the same 6 levels of vehicle autonomy used for cars to evaluate our technology's maturity: from no driving automation at all to full driving automation. This framework helps break down a complex problem into clear milestones and guides engineers to tackle increasingly complex challenges. It also assists OEMs and regulators in creating testing methods and safe spaces for technological advancements, deploying regulation based on results, and aligning expectations between stakeholders.

We can use the same iterative mindset for evaluating market readiness for innovation and emergent technologies to create strategic plan forward. Think Elon's masterplan for Tesla. First the Roadster, then Model S, Model Y and finally Model 3. Building a working prototype is easy compared to mass manufacturing and bringing a product to market. You already know the story. Well... my hypothesis is that longevity biotech will follow a similar pathway.

Inspired by these tools and without following the scientific method, I tried to classify the aging therapeutics space into six levels based on the likelihood to successfully bring to market a product (drug, intervention, etc.) that targets aging directly. I've taken into account several parameters: complexity, difficulty, investment needs, impact on pushing the space forward, regulation maturity, public opinion, logistics, affordability, etc. And although this framework is likely incomplete and mostly speculative, you go to war with the mental model you have.

Ah. The horizons are mostly a target deadline for myself, not a prediction of what is going to happen. Nobody knows what the future holds.

Level 0 → healthspan optimization

- Objective: improve healthspan

- Criteria: using known compounds, mainly supplements

- Examples: creatine, vitamins D3, K2, B12, omega-3 fatty acids, collagen peptides, hyaluronic acid, and NAD+ precursors

- Challenges: Navigating the "snake oil" landscape, no mechanism or incentive to actually test these products, companies sell them with no evidence

- Counterpoint: overemphasis on supplements might divert attention and resources from more innovative aging therapeutics research

- Companies: Elysium Health, Metro Biotech, Novos Labs and Leap Years

- Horizon: now

I almost didn't include this level here and I still don't know if I should. Mostly because it's not clear how Level 0 pushes the aging therapeutics space towards Level 1. While starting a company focused on supplements may seem attractive due to the lack of regulation, these initiatives often make only a marginal impact. On top of that one of the biggest challenges at this level is snake oil: discerning between genuinely health-promoting compounds and those that provide minimal or no benefit.

Level 1 → simple aging modulation

- Objective: slow down the aging process and increase healthy lifespan by 5-10 years

- Criteria: use a known compound to target a single aging mechanism or process

- Examples: rapamycin, calorie restriction mimetics or other known compounds that target well known pathways like AMPK, IGF-1, mTORC1

- Challenges: understanding whether certain pathways are, in fact, affecting aging, designing clinical trials and find incentives to repurpose already approved drugs

- Counterpoint: the potential benefits of extending lifespan by 5-10 years may not outweigh the costs and risks associated with repurposing existing drugs

- Companies: Loyal (known compound), The Dog Aging Project, Trivium Vet and AgelessRx (rapamycin), the AFAR with the TAME trial (metformin)

- Horizon: 3 to 5 years away

The biggest challenge for Level 1 (and Level 2) is that there are no proxy biomarkers for extending lifespan. At least none that the FDA and the scientific community agrees on. Recently a Consortium has been created to establish reliable biomarkers of aging for longevity interventions but the timeline is not certain. The space probably needs new models for running clinical trials or run trials that validate the biomarkers (so there's a chicken and egg problem).

In the meantime, there could be another option: companion animals. At the beginning of March 2023 Loyal announced that they received protocol concurrence; which means the FDA agrees with the clinical trial they proposed. The goal is to demonstrate that their dog longevity drug extends healthy lifespan: extend lifespan but also to ensure a higher quality of life during those additional years. The results will be enough to support bringing the drug to market. Loyal could be at this level because they are developing a drug that mimics caloric restriction and apparently they are not developing novel compounds.

Another challenge is to incentivize running clinical trials for current approved drugs that could be repurposed to modulate aging. Selling to Big Pharma won't work so companies at this level will need to get creative regarding business models. Some companies and organizations at this level could be The Dog Aging Project, Trivium Vet and AgelessRx with their Rapamycin trials and the American Federation for Aging Research with their TAME (metformin) trial.

Companies at this level are the most likely to be the first ones to bring an aging drug to market. They will be the ones to prove how promising is the longevity biotech market. They will become experts in collaborating with regulators, will create the first distribution channels and will become models in the space creating new playbooks on how to start and manage longevity biotech companies.

Level 2 → advanced aging modulation

- Objective: slow down the aging process and increase healthy lifespan by 10-20 years

- Criteria: use novel compounds or combinations of known compounds to target one or multiple aging mechanisms or processes

- Examples: senolytics (clearing senescent cells), selective TGF-β therapeutics, SIRT6 overexpression, klotho protein mimetics, activation of the SIRT1 and SIRT3

- Challenges: target aging instead of an indication, integration with existing healthcare systems

- Counterpoint: targeting aging rather than specific indications might lead to regulatory challenges and hinder the approval of potentially beneficial treatments

- Companies: Unity Biotechnology, BYOMass, Tornado Therapeutics, HCW Biologics, Klotho Therapeutics, Genflow Biosciences, Nusirt, Retro (autophagy) and Lento Bio

- Horizon: 5 to 7 years away

As I pointed earlier the main challenge at this level (and the following ones) is targeting aging instead of an indication (sarcopenia, Alzheimer's, etc.). Some longevity biotech companies targeting indications will succeed and others will fail. Unity Biotechnology already failed their phase 2 clinical trials. Twice. That's probably because companies only get good at what they really do; not at what they want to do, not at what they think they're doing and certainly not at what they say they're doing. The space needs more companies taking the risk of targeting aging directly. Yeah, conversations with the FDA and other regulators are challenging and will need to improve, but that's just part of the job.

If companies which started at Level 1 reach the market first and get good at testing hypothesis really fast, they will probably eclipse the ones who plan to target aging only after targeting an indication. Either by outcompeting or acquiring them.

One company that seems to be focusing on addressing aging directly at Level 2 is Retro. Although their exact approach is unclear, it is possible that they are targeting nutrient sensing to stimulate autophagy, either through a novel compound or a combination of known compounds. Their strategy is intriguing as it appears that they are attacking Level 2, Level 3, and Level 4 simultaneously. While I have no idea of how they're allocating resources across these levels, pursuing multiple product horizons could prove advantageous, if capital is not an issue. However, such an approach typically yields better results when at least one of the products is mature enough and is already generating revenue.

Level 3 → damage repair

- Objective: rejuvenate localized structures

- Criteria: use novel therapeutics that reverse structural damage at molecular or cellular level outside cells

- Examples: reverse calcification, remove arterial plaques, clear intracellular aggregates, remove crosslinks, thymus regeneration

- Challenges: develop targeted delivery systems that ensure the therapeutic agents reach the desired location with minimal off-target effects and avoid to negatively impact surrounding tissues or overall cellular function

- Counterpoint: localized structural rejuvenation could neglect systemic factors contributing to aging, potentially limiting its impact on overall health

- Companies: Elastrin, Cyclarity, Intraclear Biologics, Isterian, Lento Bio, Revel, Retro (plasma inspired therapeutics), Repair Biotechnologies and Intervenne Immune

- Horizon: 7 to 12 years away

On top of inherited challenges from Level 2, companies at this level need to develop targeted delivery systems that ensure the therapeutic agents reach the desired location with minimal off-target effects and avoid to negatively impact surrounding tissues or overall cellular function.

Without taking into account the heavy technical complexities, this level will probably be the eye of the hurricane. My hypothesis is that, by this point, the market and public opinion will be similar to where self driving cars are in 2023. Numerous clinical trials targeting aging directly would have already been conducted, and some regulatory frameworks for aging therapeutics would be in place. Established distribution channels would be ready, and while prices may remain high, they would not be prohibitive. I anticipate the emergence of long-term longevity financing options between Level 3 and Level 4.

Level 4 → cellular rejuvenation

- Objective: pause or halt the aging process at the cellular level

- Criteria: modify the fundamental genetic or epigenetic mechanisms that cause aging in cells and organelles

- Examples: telomere extension, partial reprogramming, mitochondrial enhancement, stem cell therapies, gene therapies, mitochondrial transplantation

- Challenges: demonstrate long-term safety and efficacy, eliminate cancer risk and toxicity, find new rejuvenation mechanisms, regulatory implications of altering fundamental biological mechanisms, potential for increased social inequality, unforeseen ecological consequences

- Counterpoint: not yet clear that cellular reprogramming can extend lifespan

- Companies: Retro, Altos Labs, NewLimit, Shift Bioscience, Turn Bio, Vita Therapeutics, Rejuvenation Biotech or Rejuventa Bio

- Horizon: 12 to 24 years away

Companies at this level have raised the biggest investment rounds by far: Altos Labs $3B, Retro $180M, NewLimit $105M, etc. It seems that all these companies are in fact targeting aging directly; there is just a non spoken consensus that there’s no benefit to stating that publicly. Maybe too soon?

Partial reprogramming is such a complex topic that I don't fully understand it deep enough yet to have a strong opinion about it. Some experts could argue that just because that’s how the reset between generations works, doesn’t mean it applies well to somatic bodies. But Rejuvenate Bio published in January 2023 a preprint with early results for extending lifespan in mice. We'll see.

Level 5 → comprehensive rejuvenation

- Objective: full body rejuvenation

- Criteria: using combinations of all of the above modalities plus large scale tissue replacement, tissue engineering, genetic engineering, nanotech

- Examples: tissue engineering, bioprinted organs, advanced bio-mechatronic prosthetics, nanotechnology, brain machine interfaces, replacement

- Challenges: long-term compatibility, accessibility and affordability for the general population, deep societal implications, deep economical consequences

- Counterpoint: unrealistic expectations that divert resources from more achievable, short term advancements

- Horizon: 24 to 42 years away

This level is currently in the realm of science fiction and academia. If I take the distance in complexity between Rapamycin and genetic engineering (the science) or replacement (not the science but the market, regulation, needed investment, public opinion), I personally arrive at the conclusion that these approaches won't be massively available as a product any time soon.

However both genetic engineering and replacement approaches have very unique advantages and challenges. For example, heavy genetic engineering requires computational biology and highly precise delivery and editing but could be as cheap as vaccines. Replacement is a less complex approach in some ways but requires manufacturing and medical process development, and a complete overhaul of how healthcare is delivered.

It's hard to imagine how we could deploy Level 5 before the previous levels. But I really hope I'm wrong. However I do imagine that as we advance towards this level, some companies focusing on way more futuristic approaches are going to start popping up, maybe between the transition from Levels 3 to Level 4.

For me, this framework arranges short and long-term priorities for introducing products (drugs, therapies, etc.) to market that directly target aging. Again, the horizons are mostly a target deadline for myself, not a prediction of what is going to happen. This is merely a snapshot of my current perspective, which will for sure evolve over time. With the accelerated pace of technological advancement, maintaining a useful model for the future becomes increasingly challenging. Moreover, such frameworks reflect only one individual's experience (in this case, my limited one), opinion, and narrative. I guess that what I'm trying to say is... take it with a grain of salt and perhaps focus on the underlying concept rather than the specifics.